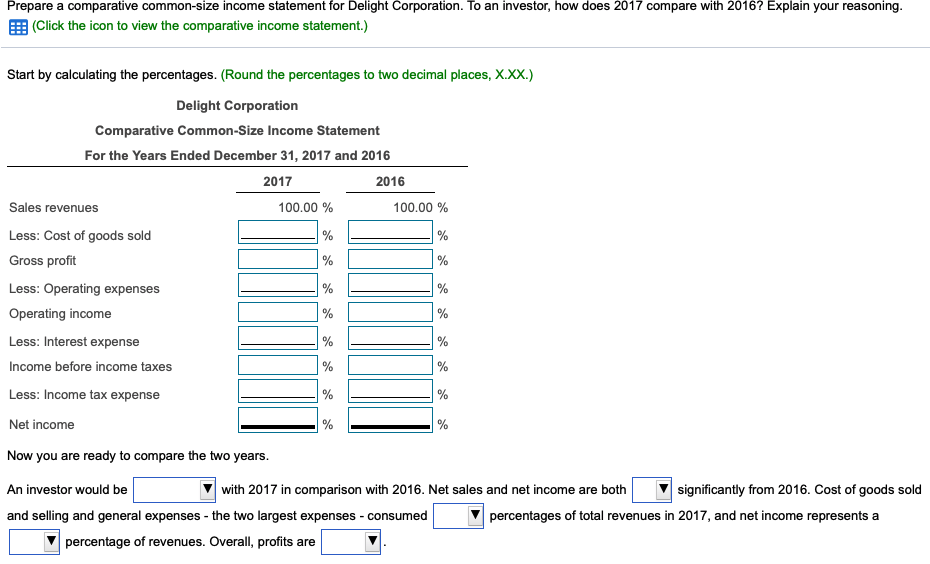

Vertical analysis consists of the study of a single financial statement in which each item is expressed as a percentage of a significant total. Vertical analysis is especially helpful in analyzing income statement data such as the percentage of cost of goods sold to sales. Where horizontal analysis looked at one account at a time, vertical analysis will look at one YEAR at a time. A common size financial statement is used to analyze any changes in individual items when it comes to profit and loss. They’re also used to analyze trends in items of expenses and revenues and determine a company’s efficiency. Owner equity, assets, and liabilities are shown in the financial statement as a percentage of total assets.

- For example, it could be cash flows from financing, cash flows from operations, and cash flows from investing.

- Common size balance sheets are used by internal and external analysts and are not a reporting requirement of generally accepted accounting principles (GAAP).

- If you just looked at numbers, it might seem like this company did better in 2022 because sales increased from $500,000 to $600,000.

- Common size statements are highly valuable in financial statements such as income statements, balance sheets, and cash flow statements.

- A common size financial statement is used to analyze any changes in individual items when it comes to profit and loss.

Income Statement Ratios

The final step is to calculate net income for the reporting period. This includes local, state, and federal taxes, as well as any payroll taxes. Interest refers to any charges your company must pay on the debt it owes. To calculate interest charges, you must first understand how much money you owe and the interest rate being charged. Accounting software often automatically calculates interest charges for the reporting period.

Common Size Balance Sheet Statement

The steps mentioned above are used to prepare the common size income statement of any business. However, it may bcome a complex process, depending on the size and nature of business operations. The overall results during the period examined were relatively steady.

Calculate Interest and Taxes

If you’re interested in finding out more about how to create a common-size income statement, then get in touch with the financial experts at GoCardless. Find out how GoCardless can help you with ad hoc payments or recurring payments. These yields and other data can be used to create a product mix common-size statement based on revenue. Columns 2-4 are repeated in the columns on the far right for the previous year.

You can use the balance sheet equation, which is assets equals liabilities, plus any stockholders equity. A vertical common size income statement is a financial statement that expresses each item as a percentage of total revenue. Doing so allows for easy comparison of different expense categories and helps identify trends in the company’s income statement over time. Common size financial statements help to analyze and compare a company’s performance over several periods with varying sales figures.

Adjustments and Expense Management

I mentioned that ROA is a very common performance metric in banking, so that’s why this table is expressed in assets. It’s a further drill-down into the components of ROA that I showed earlier. Let’s take off the training wheels and look at a more complex “real world” example. I’m going to walk through an example common-size analysis that I used many times in my banking career.

The common-size method is appealing for research-intensive companies because they tend to focus on research and development (R&D) and what it represents as a percent of total sales. It’s important to add short-term and long-term debt together and compare this amount to the total cash on hand in the current assets section. This lets you know how much of a cash cushion is available or if a firm is dependent on the markets to refinance debt when it comes due.

The common size version of this income statement divides each line item by revenue, or $100,000. COGS divided by $100,000 is 50%, operating profit divided by $100,000 is 40%, and net income divided by $100,000 is 32%. As we can see, gross margin is 50%, operating margin is 40%, and the net profit margin is 32%–the common size income statement figures.

For example, it could be cash flows from financing, cash flows from operations, and cash flows from investing. Even though common size analysis doesn’t provide as much detail, it can still be effective in analyzing financial statements. This graph starts with interest income as a percentage of assets, which is then reduced by interest expense. That’s followed by noninterest income, which includes the service fees and overdraft charges everyone hates.

The cash flow statement provides an overview of the firm’s sources and uses of cash. The cash flow statement is divided among cash flows from operations, cash flows from investing, and cash flows from financing. Each section provides additional why real estate investors should consider lease options information about the sources and uses of cash in each business activity. Thus, the above common size income statement interpretation helps investors, analysts and management to identify challenges, opportunities and growth of the company.